| ||||||

| ||||||

This article contains the following actionable observations that Boards and Bank Executives may immediately apply in establishing, achieving and sustaining high performance levels throughout their bank.

Articles:

©

- Direct involvement of line management and professional staff.

- Increasing participation throughout the organization, as initiatives progress from design to implementation.

- Balancing the focus on clients, staff and shareholders. (The most successful organizations in the world do this well , and continuously.)

- Application of measurement tools – quantitative and qualitative – to assess and stimulate progress.

Business Banking Issues

SPP’s Managing Director, Terry Parker, attended the 2010 Small Business Banking Conference hosted by American Banker and the Risk Management Association (RMA). The Conference was attended by over 300 people, representing over 80 banks and financial institutions of all sizes. The focus of the conference was “Re-Shaping Small Business,” emphasizing issues prevalent in “branch-based” business banking, as well as those arising with “business banking specialists.” Most discussion was in the context of banking clients with revenue under $20 million, concentrating on those with revenue between $1 million and $10 million. Over the course of three days, a range of presentations, discussions and case studies were explored. To access a brief summary of these topics, please click on the box to the right.

To discuss these issues in greater detail, please contact SPP.

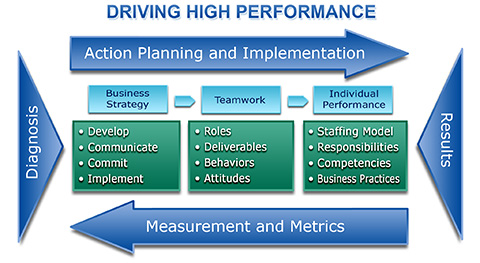

Driving High Performance