| ||||||

| ||||||

SPP’s Focus:

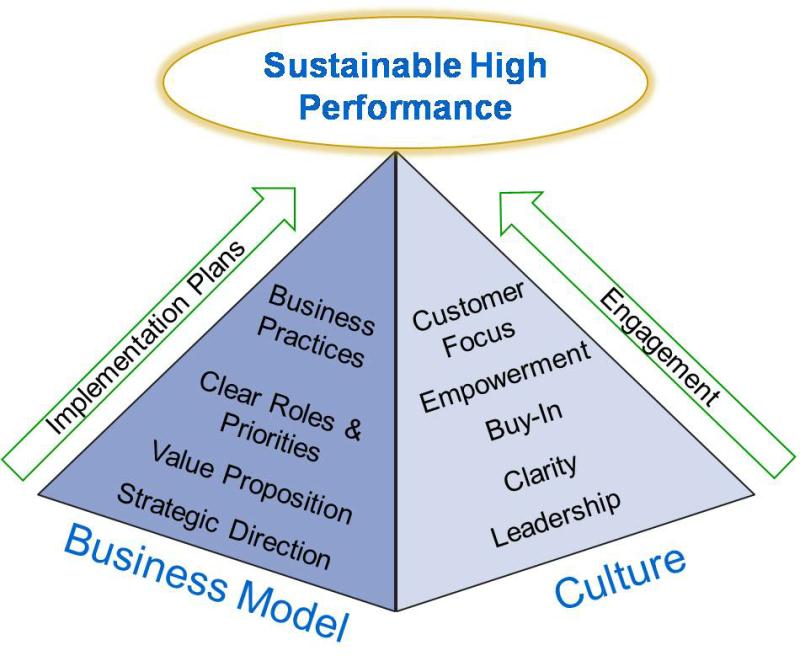

SPP helps clients improve their organizational and business performance. We do this by helping implement changes to their business model and by ensuring the culture and operating style of the bank are aligned with the business model.

Research by academic experts, SPP and other consulting firms demonstrates a clear link between improving organizational culture/performance and stronger financial performance. SPP's findings indicate that top-tier organizational performance serves as a leading indicator of a financial performance premium as high as 15%.

SPP’s Diagnostic Approach

As banks refine their business model to address the recent changes to the economy, marketplace and regulatory environment, these changes need to be:

- Implemented quickly and effectively

- Supported and reinforced by an appropriate culture and operating style.

SPP’s diagnostic assessment evaluates a bank’s ability to ‘take performance to the next level.’ The diagnostic approach considers the attributes of both the business model and the culture.

Business Model Changes

Many business models can be successful, if they are implemented well. SPP focuses on ensuring that implementation takes place in the most effective manner.

Aligning the Culture with the Business Model

However, for timely and effective implementation and sustainable high performance, the characteristics of the bank’s operating style and culture must be aligned with the business model and evolve in parallel with business model changes

Elements of an Effective Culture

If you can answer all these questions with an emphatic “YES,” your bank is well positioned to take performance to the next level. If, however, your answer is “NO” (or even a qualified “YES”), contact SPP for a preliminary diagnostic assessment, administered with our compliments.

©

Strategic Direction:

Value Proposition:

Clear Roles and

Priorities:

Business Practices:

Implementation

Plans:

Are the key attributes and components of the strategic direction clear to employees?

Is the bank's customer value proposition clear to employees with customer contact? Do they know how to communicate and fulfill the proposition?

Do employees have a clear understanding of how changes to the business model will affect their role and priorities?

Are routine activities and business practices closely aligned with the strategic direction, value proposition, roles and priorities?

Has the implementation plan been clearly communicated to employees? Does it have credibility?

Keys to Effective Implementation

Leadership:

Clarity:

Buy-In:

Empowerment:

Customer Focus:

Employee

Engagement:

Are the bank's leaders effective communicators, role models, motivators and coaches?

Are key components of the bank's business model and desired culture clear to all affected employees?

Do employees believe in the business model?

Do managers and employees at various levels have the right degree of empowerment to implement the plan?

Are all employees appropriately focused on the desired customer experience?

Are employees 'engaged' and committed to the bank's success?